Software Leaders: Blue Prism’s Ijoma Maluza on scaling a finance function on the path to a $1.6B exit

In our Software Leaders series, proven operators from the world’s top software companies share learnings and resources for teams earlier in their growth journey. This edition was based on a working session held between Expedition operating advisor, Ijoma Maluza, and several leaders from our portfolio companies. Ijoma was CFO at UK-founded Blue Prism, an RPA software provider with bootstrapped roots, for over 4 years, overseeing a period of dramatic growth from fewer than 200 employees up to over 1000 employees, £190 million in ARR and a $1.6 billion strategic acquisition by SS&C in December 2021.

Always be ready for a liquidity event

You never know when the time will come during the life of your business for an offer of investment or acquisition that you might want to take seriously. The question Ijoma asks from experience is: if you were in that situation tomorrow, what are the key questions that investors are going to ask you? Do you have the data and answers to hand or are you going to have to scramble that together? Having these things prepared and reporting on them over time is very important. For Blue Prism, net retention was a particularly critical metric for the equity story, so having robust data and reporting around this was key.

Finance is critical to business success, beyond transactional finance

Right from the early days at Blue Prism, Ijoma had two subgroups within his finance team:

(i) financial controller / transactional finance team focused on billing, payments and statutory financial reporting;

(ii) FP&A team focused on RevOps, unit economics and forecasting.

The second team was a strategic enabler for the whole business, and for several years key tactical decisions were made based on a single weekly report prepared by Ijoma’s FP&A leader.

In addition to strategic data analysis, Ijoma sees significant value coming from the finance team in terms of creating necessary governance and guardrails for the business to operate in a resilient way. This includes policies, procedures and oversight. On Ijoma’s journey – while internal guardrails are always a key pillar – from around £100M in ARR, there was a significant jump in risk frameworks and internal audit sophistication.

Managing expectations (internal and external) is key to valuation and cost of capital

To build conservatism into how the business plans and operates, Ijoma typically operates several ‘cases’ for financial performance. The Sales Case is the target that’s achievable based on current metrics and is used as the baseline for sales compensation; the Management Case takes a slight haircut to this such that the management team have high conviction to hit this case; the Board Case takes an additional slight haircut to this and enables C-level executives ideally to beat expectations at the board level on a consistent basis.

Finally, if the company is listed on the stock market, Ijoma also runs a Street Case (as in Wall Street) which is an additional haircut case shared with external analysts and investors. Valuation is always forward looking, and for public companies in particular any missed budget can lead to a significant downgrade in valuation and a higher cost of capital for new equity or debt as a result, so prudent expectations management is critical.

Remember that your budget today will be reviewed for at least 2 to 3 years – including in a potential future liquidity event – so setting appropriate and achievable expectations is an important component of responsible financial management and value creation.

The finance team is a team

Ijoma’s approach in building his team is to bring people into his team who can do things that he cannot do as well, and then empower them to grow and succeed. At Blue Prism, Ijoma added new layers to the finance team over time as the business scaled, growing from 8 FTEs in finance when Ijoma joined to 50 (i.e. 5% of total headcount) when the company was acquired.

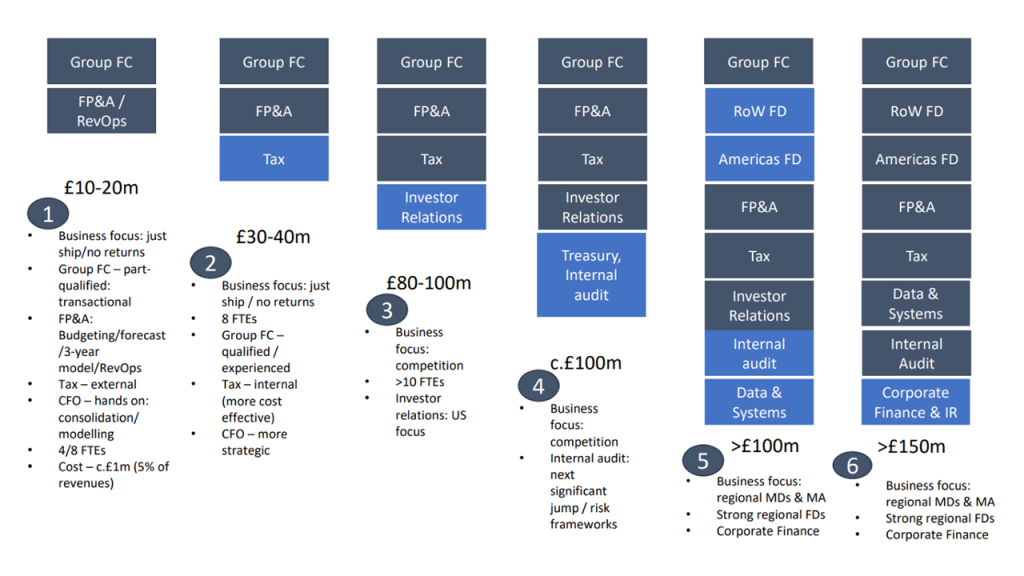

The progression of Ijoma’s finance team at Blue Prism from early scaling to >£150 million ARR

In terms of team progression, Ijoma sees financial control and FP&A as the two core functions to own internally up to £10-20M ARR, and then bring other specialisms in house later down the line, including tax, treasury, internal audit, corporate finance and others.

Watch out for blind spots – not purely finance but business blind spots

Finance team members have access to a huge amount of information, including data points which are not purely financial. Ijoma sees the finance team’s role fundamentally as helping the business to make better decisions, bringing a uniquely cross functional view of the business – constantly interacting with sales, marketing, customer success, end customers and other key stakeholders. Culturally, avoiding business blindspots is about encouraging curiosity and asking questions.

One tactical way that Ijoma avoids shocks to the business is by scenario-based budgeting. A key learning is to build enough time in your budgeting process to build robust upside and downside scenarios and then study the leading indicators. If ‘this’ happens by the end of Q1, then we’ll pivot to a certain path. Too often, scenarios are a rushed, shallow exercise ahead of a board meeting – but done thoughtfully, they can be an instrumental tool for course-correcting through a given year in response to period-to-date actual indicators.